Are Value ETFs the Best Way to Play this Market?

Another week, another string of all-time highs for the domestic markets.

That’s good if you’re long in this market, and we are in my Successful ETF Investing advisory service. Yet despite the bullish mood and the new-high headlines, this rally remains largely dependent on the fate of politics for its sustenance.

The bottom line is that if President Trump and his Republican allies in Congress can execute on the pro-growth proposals such as Obamacare repeal/replace, regulatory rollback of laws such as Dodd-Frank and, most importantly, corporate tax reform, then this market can sustain the record uptrend. It also can justify its relatively high valuation.

Of course, not all types of exchange-traded funds (ETFs) are created equal when it comes to putting money to work in this market. The key to success today is to take advantage of the Trump-induced developments by using a combination of broad-based and sector-specific exchange-traded funds. That’s what we are currently doing in Successful ETF Investing, and it’s what we intend to keep doing.

Right now, the “Trump trade” is one in which cyclical sectors are likely to benefit, including Trump-specific sectors such as aerospace and defense, building materials, financials, etc. However, there are two broader ways to play the Trump trade that are a bit less intuitive, but that could be sound ways to gain exposure that’s not quite as far on the risk curve as sector-specific ETFs.

What both funds have in common is that they are value-oriented. As such, they offer a measure of protection from market pullbacks vs. the more cyclical sectors.

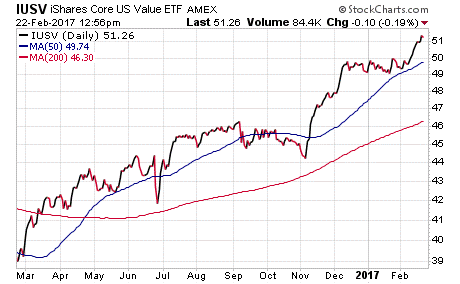

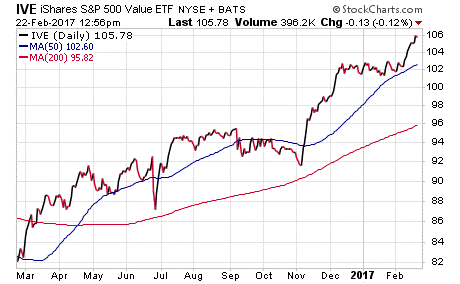

Two specific ETFs I like here are the iShares Core S&P U.S. Value ETF (IUSV) and the iShares S&P 500 Value ETF (IVE).

These funds offer us a good combination of reasonable valuation and favorable sector make up (sectors I suspect will outperform in 2017 are heavily weighted in these ETFs compared to the S&P 500). Both also have seen strong post-election outperformance.

With IUSV, we get a great mix of sectors likely to outperform in 2017, including financials (27%), healthcare (9.7%), energy (13%), consumer staples (7.6%) and industrials (10.2%). Meanwhile, IVE has similar sector exposure, with the main difference being health care at an 11.5% allocation and industrials at an 8.7% allocation.

This difference won’t be significant in terms of overall performance, but the over-allocation to health care in IVE gives you that little extra contrarian exposure if you think, as I do, health care has been unfairly battered over the past year.

Finally, both funds offer us exposure to a continued rotation out of defensive sectors and towards higher-beta, more cyclical stocks and sectors… while also not putting us too far out on the risk curve if the Trump pro-growth agenda breaks down.

If you want to find out how, and more importantly, when to buy these and other ETFs running higher due to the Trump trade, then I invite you to check out Successful ETF Investing today!

ETF Talk: Featuring a Behemoth Financial Sector Fund

By Eagle Staff

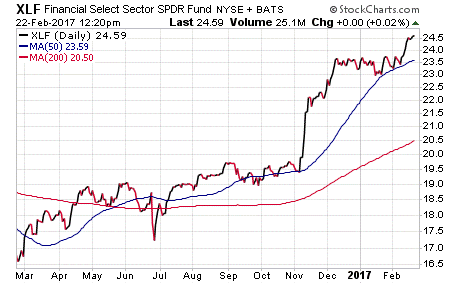

An exchange-traded fund (ETF) in the financial arena that is worth highlighting is the Financial Select Sector SPDR ETF (XLF), which tracks a market-capitalization-weighted index of S&P 500 financial stocks.

As a result, in contrast to two previously featured funds — KBE and KRE — XLF concentrates on the large U.S. banks and steers clear of small-cap financial institutions. With $24.94 billion in total assets and daily trading volume nearing $1.4 billion, XLF is a behemoth that also is massively liquid.

In the past year, XLF alone accounted for more than half of all inflows that flowed into financial ETFs. The fund’s valuation has increased by nearly 45% over the past year. With the expected upcoming interest rate hikes from the Fed, financial experts at Barron’s anticipate that large banks have much to gain.

Another attraction for this fund is that it has a very active trading pit for options. Since December 2016, XLF has been buying a lot of puts to set up a more defensive stance. This helps to limit downward risk, in case unfavorable regulations are passed against the large banks.

XLF charges a low fee for its services, with an expense ratio of just 0.14%. On top of that, it also carries a distribution yield of 2.47% and pays a quarterly distribution. The fund’s one-year return is 34.92%, handily beating the S&P 500’s one-year return of 17.45%.

XLF holds 63 of the largest financial institutions in its portfolio. Its top five holdings are JPMorgan Chase & Co (JPM), 10.76%; Berkshire Hathaway Inc B (BRK.B), 10.67%; Wells Fargo & Co (WFC), 8.75%; Bank of America Corporation (BAC), 8.26%; and Citigroup Inc. (C), 5.71%.

If you believe in the strength of the largest U.S banks, we encourage you to research Financial Select Sector SPDR ETF (XLF) as a possible addition to your portfolio.

As always, we are happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

Even Leftists are Embracing the Trump Trade

Haters are gonna hate, as the kids these days say. But the smart haters are going to hate while also making money.

That’s precisely what leftist icon, and billionaire manipulator of markets, George Soros, has decided to do.

The big money behind so much liberal activism is no fan of President Donald Trump, but when it comes to making money, Soros is a fan of results.

So, when I read Soros’ recent 13F filing with the Securities and Exchange Commission (SEC), which requires a disclosure of holdings of institutional investment managers with over $100 million), it didn’t surprise me that Mr. Soros had embraced the Trump-on trade.

The record shows that in fourth-quarter 2016, Soros Fund Management took a $14.9 million stake in investment bank Goldman Sachs (GS). Yet GS wasn’t the only financial holding Soros embraced.

Soros also bought some $3.1 million shares of the Financial Select Sector SPDR (XLF).

Given the fact that since Election Day, XLF has surged some 22.6%, it’s no wonder a shrewd investor such as Soros would swallow his political pride and embrace the “Trump-On” trade in markets that I’ve been telling you about for weeks.

The moral of the story here is though you may love or hate a certain fact of reality, your money doesn’t care.

Your money, and your investing decisions, should always be objective.

That means that regardless of how you feel about a given fact of reality — especially about a particular politician in office, or a particular policy, or a particular law — if there is an investable angle associated with that fact, it needs to be evaluated for possible inclusion in your portfolio.

In broader, philosophic terms, this is consistent with the axiom I live by called the “primacy of existence.” All of this really means is that you see the world for what it is, i.e. facts are facts, independent of how we might want them to be.

Right now, the market is trading Trump on. That’s a fact of reality that investors fail to acknowledge at their own financial peril… and even haters like George Soros know that.

Call the Smithsonian

Call the Smithsonian, I made a discovery

Life ain’t forever and lunch isn’t free

Loved ones will break your heart, with or without you

Turns out we don’t get to know everything…

— The Avett Brothers, “Smithsonian”

Sometimes the most profound thoughts can come via folk rock lyrics. That’s the case here with the song “Smithsonian” from alt-country/folk rockers The Avett Brothers. One important takeaway, among many, from this song is that our knowledge — and our time — is finite. When it comes to investing, we all have limited time frames, and we definitely can’t know everything. We can, however, put our knowledge, experience and intuition to work for us in an effort to make our lives better in the time we have. So, call the Smithsonian, and tell them that’s what you’re doing by reading this publication!

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.

In case you missed it, I encourage you to read my column from last week about a small-cap bank fund.