A Dangerous Glitch in the ETF Matrix

On Tuesday, the markets belched a big decline, experiencing their first drop of more than 1% in the major indices in some 111 trading days. That’s a long time without the sellers asserting themselves, and it was a pullback that was long overdue.

Markets have settled a bit today, but make no mistake, the selling across the board Tuesday was Wall Street letting Washington know that if there is no progress on Obamacare repeal/replace when the House votes on Thursday, then equity values are going to get rocked.

As I’ve said many times here in this publication, and to subscribers of my Successful ETF Investing advisory service, the key to keeping the Trump rally going is material progress on the pro-growth policy agenda.

Anything that threatens that agenda from passing through Congress is going to be stock market negative. Now, it appears there will be a close vote in the House on passage of the Republican health care bill. If that bill goes down to defeat tomorrow, look for the markets to make a Tuesday redux.

Conversely, if the health care bill is passed in the House, then I think markets could experience a sort of relief rally, i.e., relief that something can get agreed upon in at least one side of Congress. The issue then goes to the Senate, where the bill will be reworked again. Uncertainty about the bill’s passage no doubt will cast a shadow of doubt and apprehension over Wall Street.

Now, because Tuesday’s sell-off captured all of the headlines, there was one important bit of news that largely went unnoticed on Monday. That news was a glitch at the New York Stock Exchange’s Arca platform in which most exchange-traded funds (ETFs) trade. The glitch resulted in 341 securities not completing their closing auction successfully.

According to media reports, it was a botched software update that caused many popular ETFs, including the SPDR Gold Trust (GLD), to fail to settle at the closing auction.

The closing auction is held in the final minutes before the market’s 4 p.m. close. This final flurry of trading is critical, as it determines the daily settlement price for each stock or ETF. It’s also important because big investment houses and big traders frequently pile into the closing auction with big orders as the trading day nears.

This “glitch in the Matrix” (a 1999 sci-fi film reference) is by no means the first such glitch that’s negatively affected ETFs. On August 24, 2015, a massive glitch in the NYSE trading matrix caused many ETFs to open 30%, 40% and even 50% lower than their previous close.

I recall that moment of high anxiety quite vividly, as Doug Fabian and I scrambled to make sense of what was happening and to protect any positions we had. Fortunately, Successful ETF Investing subscribers had a Fabian Plan Sell signal on at the time, so we had little exposure to the glitch.

Still, the idea that something like a software update can cause real-money losses to investors is something that we always must be on guard against. It also is something that only gets corrected if people are aware of it, and only if we demand corrective action.

That’s what I’m doing today in writing about this issue, and that’s why I want you to know about it as well.

*************************************************************

ETF Talk: Investing in the Euro Zone

By Eagle Staff

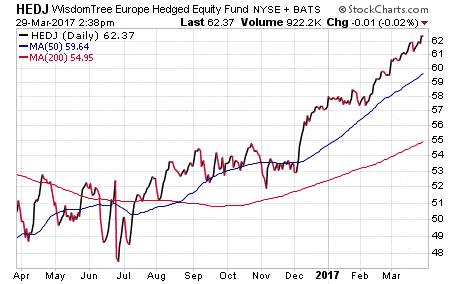

European markets consistently have underperformed the United States for several years, but it seems as if a revival is now taking place. One way to invest in companies from a large number of countries in the Euro zone is through the WisdomTree Europe Hedged Equity ETF (HEDJ).

The term “Euro zone” refers to European countries that use the euro as their national currency, meaning that countries such as France, Germany, Greece, Italy and Austria are included under this umbrella. As a whole, the Euro-zone economies are gaining strength, with 2016 representing the first time since the 2008 financial crisis that the Euro zone’s gross domestic product (GDP) grew at a faster rate than the United States’ GDP, with growth of 1.8% versus 1.7%, respectively.

Originally created in 2009, HEDJ seeks to provide investors with exposure to a broad range of Euro-zone equities and companies, many of which pay dividends. While HEDJ offers access to the entire Euro zone, the fund is primarily invested in Germany, 25%, France, 24%, Spain, 19%, and the Netherlands, 16%. The industrial, consumer discretionary, consumer staples and financial sectors make up the majority of HEDJ’s allocated investments, at a little more than 66% of total assets.

As a currency-hedged fund, HEDJ strives to mitigate currency fluctuations of the euro relative to the U.S. dollar.

Although the fund is only eight years old, HEDJ has become a popular ETF, currently boasting about $9.6 billion in net assets. When compared to broader European ETFs, such as the Vanguard FTSE Europe ETF (VGK), HEDJ has outperformed nicely over the course of the past year. Year to date, HEDJ is up close to 8%, better than the roughly 6% rise in the S&P 500.

This fund has a moderate expense ratio of 0.58% and a respectable yield of 2.63%. Its top five holdings include Telefonica S.A., 5.84%; Banco Bilbao Vizcaya Argentaria S.A., 5.42%; Banco Santander S.A., 4.74%; Siemens A.G., 4.73%; and Daimler A.G., 4.58%.

Keep in mind that 2017 looks to be an uncertain year for the euro, as several countries, including France, potentially could abandon the European Union. As such, investing in European countries right now involves a degree of risk, but this may be counterbalanced by the fact that investing internationally offers just as much appeal as investing domestically for the first time in a while.

If you are interested in taking a broad swipe at prominent European countries and equities, then the WisdomTree Europe Hedged Equity ETF (HEDJ) could be a good place to start.

As always, we are happy to answer any of your questions about ETFs. So, don’t hesitate to send us an email. You just may see your question answered in a future ETF Talk.

***************************************************************

Is the Fed’s Decision the End of the Easy Money Era?

The Federal Reserve did what I, and nearly every Wall Street soothsayer, thought the U.S. central bank would do last week, and that is raise the benchmark federal-funds rate by a quarter percentage point to a range between 0.75% and 1%. The central bank also announced it expected to continue raising rates “gradually,” if the economy continues to perform in line with its forecasts.

Perhaps most importantly, Fed Chair Janet Yellen and her colleagues expect to raise rates two more times before the end of the year. The prognosis for three total rate hikes in 2017 (the first being March 15) is what Wall Street was betting on. If the Fed had indicated that there would be four rate hikes in 2017, it would have been taken as very “hawkish.”

Another important outcome of the Fed decision was that the central bank kept its projections for three quarter-point rate hikes in 2018. The reason that matters is that markets can now plan on the cost of capital rising at a steady, but also a gradual (there’s that word again) pace for the next couple of years.

Think about this for a moment. It has been about a decade since the market had to worry about the pace of interest rate hikes.

And while interest rates are still very low by historical standards, the end of “ZIRP,” or the zero-interest-rate policy, that dominated the financial landscape since 2009 now is definitively over.

This change in Fed zeitgeist is going to have widespread, long-term implications for stocks, bonds, the dollar, commodities, mortgage rates, the real estate market, etc. Just about everything economically is affected by interest rates. As such, investors are going to have to roll with the changes wrought via the end of the easy-money era.

The question for you is… is your money ready to adapt to that change?

Subscribers to my Successful ETF Investing advisory service already have been positioning their money for the new reality of higher interest rates.

If you’d like to find out how we are doing that in both our income and growth portfolios, then I invite you to check out Successful ETF Investing today!

****************************************************************

Happy Birthday, Mom

“My mother had a great deal of trouble with me, but I think she enjoyed it.”

— Mark Twain

Today is my mother’s 80th birthday, so please indulge me for a moment and allow me to say: Happy birthday, Mom. To give you a sense of the kind of mother she is, she’s the parent that raised an eyebrow if I came home with an “A-” on my report card. “Well, Jim, it appears as if there’s room for improvement.”

While her exacting nature can be exasperating at times, it also comes with a whole lot of benefits. You see, my mother introduced me to literature, philosophy and natural science at an age well before most of my peers. She taught me the value and beauty of a logical argument and a poetic turn of phrase. She also taught me the virtue of studying the great ideas of history so that they could be applied to my own life. These are the values I live by today, values instilled in me by a woman born 80 years ago, today.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.

In case you missed it, I encourage you to read my column from last week about whether the Fed’s decision to raise rates will end the era of easy money