ETFs and the Music of the Markets, Part I

What do exchange-traded funds (ETFs), music and the markets have in common? Well, aside from the fact that I happen to love them all, ETFs, music and the markets have a lot in common.

Here’s a little analogy to help illustrate my point.

Remember the 2004 biopic “Ray” starring Jamie Foxx in the lead role as Ray Charles? I suspect you may have seen it and, if you haven’t, I highly recommend it. Foxx won an Academy Award for his portrayal of the great singer, songwriter and pianist, and the film was a no-holds-barred look at Charles’ life.

In preparing for the film, Ray Charles sat down with Jamie Foxx, who also is a classically trained pianist, to play the piano together and exchange musical vibes.

Here’s how Foxx described the encounter in an interview with best-selling author and podcaster Tim Ferriss.

“As we’re playing, I’m on cloud nine. Then he [Ray Charles] moves into some intricate stuff, like Thelonious Monk. I was like, ‘Oh Sh*t, I gotta catch up’ and I hit a wrong note. He stopped because his ears are very sensitive: ‘Now, why the hell would you do that? Why you hit a note like that? That’s the wrong note, man.’ I said, ‘I’m sorry Mr. Charles,’ and he said, ‘Let me tell you something, brother. The notes are right underneath your fingers, baby. You just gotta take the time out to play the right notes. That’s life.’”

Wow, that is life indeed.

When applied to investing, we can say that the music of the market also dictates that we “take the time out to play the right notes.”

You see, the proliferation of ETFs over the years also has put the “right notes” underneath our fingers. In fact, today we can literally get portfolio exposure to just about any segment of the market by tapping on the computer keyboard that’s right underneath our fingers.

And while doing this right may be easier said than done, it can and is being done by all sorts of investors, worldwide.

Of course, the key to becoming a good musician, and to knowing the right notes to play, takes a whole lot of deliberate practice, knowledge and cultivated skill. It is the same way with investing.

Part of our mission here in the Weekly ETF Report is to help you acquire the knowledge and the skill to be able to play the right notes in your portfolio.

In the weeks to come, I will be showing you my techniques to help you identify the right notes when it comes to selecting winning ETFs for your portfolio.

Many of these techniques are at the heart of the proven, trend-following investment plan that’s helped investors preserve and grow their capital for over four decades in my Successful ETF Investing advisory service.

So, tune in next week for the second installment of ETFs and the Music of the Markets… I think you’ll find the melody quite pleasing.

Special Announcement: Watch Our New YouTube Investment Channel Online

From the desk of publisher Roger Michalski: We’re thrilled to announce the launch of our new Stock Investor YouTube channel, featuring videos from our team of financial experts. Our latest video is from Mike Turner, and it’s called: “A High-Probability Way to Predict the Price of an Investment 90 Days Out.” I encourage everyone to check it out today. And, if you find these videos helpful, please let us know by selecting the “like” button.

*************************************************************

ETF Talk: 3D-Printing Fund Rises

By Eagle Staff

ARK 3D Printing (PRNT) is a unique exchange-traded fund (ETF) that focuses on the advent of one of the biggest technological advancements of our time.

3D printing refers to the process of creating three-dimensional objects. Theoretically, almost anything can be “printed,” ranging from a slice of pizza to electric cars.

PRNT is the first ETF to track an index composed of stocks that are directly involved in 3D printing and 3D-printing-related businesses. Those businesses include printing software, hardware, printing centers and scanners. The fund is roughly two-thirds invested in U.S. equities and one-third in overseas markets (mostly Europe), but could expand its holdings to several Taiwanese technology companies.

Drawing strength from the inherent push for technological advancement around the world, managers of PRNT are expecting 3D printing to revolutionize manufacturing. As the technologic basis for 3D printing gradually enters a more mature phase, some analysts estimate that 3D printing soon will appeal to a wider audience, which would be excellent news for PRNT.

In September 2016, General Electric (GE) spent $1.4 billion on two large acquisitions of 3D printing companies Arcam and SLM Solutions. GE also plans to bring 1,000 3D printing machines online over the next decade in a huge commitment.

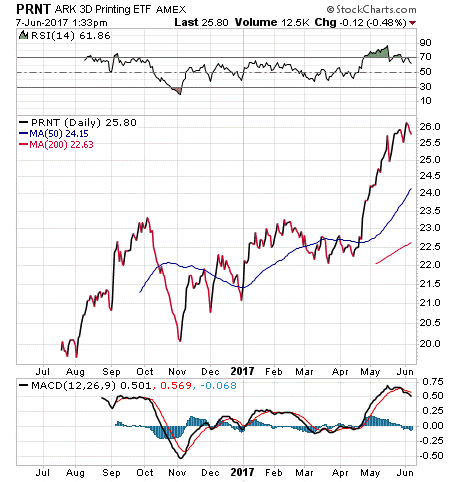

Year to date, PRNT has returned 13.80% to beat out the S&P 500’s return of 8.63%. From the chart below, you can see that the price of PRNT started off the year in an uncertain fashion but has sharply spiked in the last month by about 16% to trade in the $26 range. PRNT has an expense ratio of 0.66% and does not pay a dividend.

Top holdings for PRNT include 3D Systems Corp (DDD), 6.59%; ExOne Co (XONE), 6.48%; MGI Digital Technology (ALMDG), 6.43%; Stratasys Ltd. (SSYS), 5.57%; and SLM Solutions Group AG (AM3D), 5.38%.

If you believe in the strength of the growing 3D printing industry, we encourage you to look to ARK 3D Printing (PRNT) as a possible addition to your portfolio.

As always, we are happy to answer any of your questions about ETFs, so do not hesitate to send us an email. You just may see your question answered in a future ETF Talk.

**************************************************************

You Won’t Guess Which ETF Just Hit an All-Time High

If I asked you to venture a guess at which S&P sector ETF just hit an all-time high, you might say something like the Technology Select Sector SPDR (XLK) or the Consumer Discretionary Sector SPRD (XLY).

Those would be good guesses, and each does trade close to its respective all-time high.

But recently, the S&P sector that hit an all-time high was… utilities.

If you didn’t guess right, don’t worry. Even I didn’t get the right answer when a colleague asked me that question, and I monitor the markets the way a fortune teller with Obsessive-Compulsive Disorder (OCD) reads tea leaves.

That’s right, the Utilities Select Sector SPDR (XLU) just vaulted to a record high as part of its near-12% surge through the first five-plus months of the year. That performance trounces that of the overall S&P 500, which has put in a very respectable 9% year-to-date win.

The reason why I, and likely most readers, failed to guess utilities as the sector making new highs is because this sector is the ultimate in defensive stocks. This is the sector you go to when you’re worried about the future of stocks, and when you think a more safety-oriented approach to the market is warranted. It’s not a sector that you would think would be fueling the recent rise to all-time highs in the S&P 500.

Yet that’s what’s happened this year, and investors are rightly asking why.

To dig a bit deeper for an answer, I consulted my go-to market watcher, Tom Essaye of the Sevens Report.

Tom explained to me that while it may surprise some that defensive sectors such as utilities are outperforming this year, when you think it through, it actually makes perfect sense.

According to Tom, there are four reasons why the smart money is embracing safety.

“First, economic growth has not been good in 2017. Most people haven’t noticed because stocks keep hitting new highs, but our economy appears to be losing momentum. Second, geopolitical tensions have risen (i.e. North Korea). Third, Washington is an utter mess. There’s been no progress on tax cuts or pro-growth policies. Finally, the 10-year bond yield has reflected all these different factors, and recently hit the lowest level since October,” explained Tom.

Here we see that the penchant by investors for utilities is just a logical reflection of the very real problems brewing in this market… problems that could threaten to bring this bull market to a halt.

So, how do you invest in a market where the major indices are making new highs, but one that’s also fueled by defensive buying?

It’s a great question, and one that we address in my Successful ETF Investing newsletter. You see, having the mix of the right sectors during the right markets is one key to outperforming, and that’s what we do in this service.

***************************************************************

Can We Call It A Loan?

Oh, oh, if I’d only known, aah, what your heart costs.

Oh, oh, can we call it a loan,

And a debt that I owe on a bet that I lost?

— Jackson Browne, “Call It A Loan”

The great Jackson Browne is one of my favorite artists, as his blending of thoughtful lyrics and beautiful melody has few rivals. In “Call It A Loan,” the singer/songwriter reminds us that any value of any significance requires intense commitment, and often an all-out willingness to take on a big emotional debt. Yet rather than something to be feared, the willingness to put it on the line for your values is something we all need to embrace. The struggle is real, and if our values are right… the struggle is worth taking out the loan.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.