The Case for Going International, Part II

In our last issue, we outlined the case for going international with more of your equity allocations. The reasons why were actually quite simple.

First, a strong U.S. dollar is bearish for currencies such as the euro and the yen, and weak currencies in these respective markets are equity bullish.

Second, on a valuation basis, international stocks are relatively inexpensive compared to U.S. stocks. For example, the price-to-earnings (P/E) ratio on stocks in Europe and Japan is, on average, about 12-13. The P/E ratio on stocks in the S&P 500 is roughly about 19. This means international stocks offer a better value proposition than domestic stocks at this juncture.

Finally, after struggling throughout much of the past two years, stocks in the Far East, Europe and Japan all are enjoying technical breakouts. This is true not only for developed international markets, but also for emerging markets.

Take a look at the chart here of the Vanguard FTSE Emerging Markets ETF (VWO). After a sharp post-election sell-off, emerging market stocks are off to a great start in 2017.

VWO now is back above its 50-day and 200-day moving averages, both bullish technical signs indicating the money flows are moving in to this segment.

The same is true for perhaps the biggest emerging market out there, China. The chart here of the iShares China Large-Cap ETF (FXI) also shows the post-election selling and the subsequent return of favor above both short- and long-term trend lines.

Once again, the moves in international money flows have captured my attention, and it’s something I think you should pay attention to as well.

Right now, subscribers to my Successful ETF Investing advisory service have been repositioning their portfolios to gain more exposure to international stocks.

If you’d like to find out exactly how we’re taking advantage of this rotation into international funds, I invite you to check out Successful ETF Investing right now.

*************************************************************

A Special Announcement, Part II

For nearly four decades, I have been involved in writing my family’s newsletter, Successful ETF Investing, along with the ancillary publications such as this one.

I want to tell you that it’s been the honor and a privilege of a lifetime to have had the opportunity to serve you in my capacity as editor of this service. However, now it’s time for me to step down from my post, and to pursue new opportunities for myself and my family. Toward that end, I am joining a national wealth management firm to better serve my current wealth management clients and to help more families on an individual basis build and grow their wealth.

This move not only requires my full attention, it also comes with a set of regulatory rules that require that I am only involved in one investment business. And while I would have liked to have continued my tenure as editor of this publication, I have too much respect for you, the reader, to ever short-change you with less than my full attention.

So, effective Feb. 1, I will be handing off my editorial responsibilities to my Senior Writer, Jim Woods.

I’ve worked with Jim on the newsletter, as well as on the Weekly ETF Report, for nearly 14 years. He has been my editor for most of that time, and he’s been the wordsmith behind the scenes. Jim will be assuming the duties of editor from here on, and I must tell you that I could not have left my publications in better or more eminently capable hands.

In addition to being my right-hand man at this publication over the past 14 years, Jim also is extremely accomplished in the industry. He has written for numerous publications, including MarketWatch, Traders Reserve and InvestorPlace.

Jim also is an accomplished stock picker. In the five-year period from 2009 to 2014, the independent firm TipRanks ranked Jim the No. 4 blogger in the world (out of more than 9,000). TipRanks calculates that from 2009 to 2014, he made 378 successful recommendations out of 506 total, earning a success rate of 75% and a 16.3% average return per recommendation.

These are the kind of capable hands I’m talking about, hands that I know will take expert care of this service.

Now, here’s a message from Jim.

***********************************************************************

Thank You, Doug (by Jim Woods)

When someone with the investment gravitas of Doug Fabian thinks highly enough of you to hand over his family business to you, your first reaction is an amalgamation of humility, gratitude and excitement.

Humility comes from finding yourself with the good fortune in life to know the right people, and to be able to do what you love for a living. Gratitude is felt when your work engenders the requisite confidence that you can continue upholding the legacy of a stalwart financial publication. Excitement stems from the possibilities for delivering outstanding investment advice to readers.

I think 2017 is going to be a very interesting year replete with big opportunities in all sorts of sectors. Yet 2017 also likely will be fraught with peril, as the unknown quantity that is President-elect Donald Trump represents a market wild card of the sort we’ve never seen.

Still, I think we could be on the verge of a new American renaissance, especially if there is a long-overdue embrace by the country of capitalism, free markets and a respect for those who create wealth.

In fact, my love for the principles of capitalism, free minds and free markets is nearly purist in nature, and that’s why I love the investment business. It is perhaps the one segment of society where the primary objective is to unapologetically make money for as many people as you can.

In 2017, I suspect we will embrace many sectors that reflect the feeling of optimism inherent in capitalism, and we’ll do so by showing you the ETFs that allow investors to take advantage of that renewed sense of possibilities.

To the best within us,

Jim Woods

*************************************************************

ETF Talk: Seeking China’s ‘Wave of the Future’

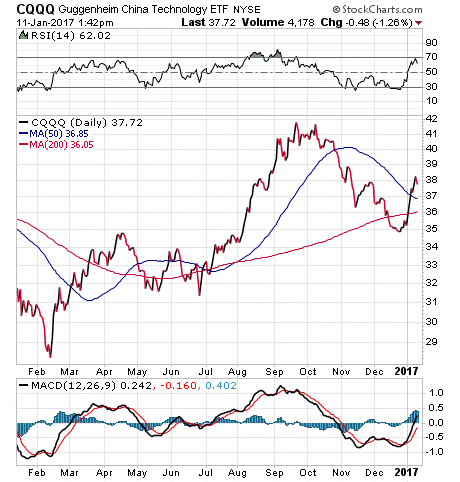

Technology stocks, often considered the “wave of the future,” can provide relatively strong growth prospects because the industry evolves at a faster rate than many others. One exchange-traded fund (ETF) that combines the promise of technology with the high-growth emerging market of China is the Guggenheim China Technology ETF (CQQQ).

This fund invests in technology companies based in mainland China, with allowances made for Hong Kong and Macau-based companies if most of their revenues come from China, Hong Kong and Macau. Market capitalization is a factor for index inclusion here, with a requirement of $200 million being the threshold for initial inclusion in the fund.

As a result, CQQQ’s top holdings are some of the biggest names in Chinese technology, and nearly 60% of the assets are invested in Hong Kong-based companies.

Over the last year, this fund has increased in value by 8.3%, not quite living up to the 12% return posted by the S&P 500 in that time. It pays a 1.66% yield and has an expense ratio of 0.70%.

The fund’s total assets are about $47 million. This means that it is below my recommended threshold for investment, but its strategy is one that is worth bringing to your attention. And 2017 could be a very different year for international and emerging stocks than what we saw in 2016.

The top five holdings for this fund are Tencent Holdings, 10.15%; Alibaba Group, 8.83%; Baidu Inc., 8.02%; NetEase Inc., 6.94%; and Semiconductor Manufacturing, 4.79%. The fund’s assets are concentrated in its top holdings because of its market-cap weighting. All told, there are about 75 positions in the fund at any given time.

If investing in a double-whammy of growth possibilities appeals to you, Guggenheim China Technology ETF (CQQQ) could be a good place to start your research.

As always, I am happy to answer any of your questions about ETFs, so do not hesitate to send me an email. You just may see your question answered in a future ETF Talk.

****************************************************************

Renaissance Man Wisdom

“A man can do all things if he but wills them.”

— Leon Battista Alberti, Renaissance architect

The wisdom of the Renaissance era is unparalleled in history, as that is when humans were celebrated for bringing reason, knowledge, multiple interdisciplinary skills and a fresh outlook to the world and its challenges. In some ways, this is how I view my successor. He’s a man whose personal philosophy echoes that of Renaissance men like Alberti, and I think you’ll see that reflected in his writing and his thinking.

Wisdom about money, investing and life can be found anywhere. If you have a good quote you’d like me to share with your fellow readers, send it to me, along with any comments, questions and suggestions you have about my audio podcast, newsletters, seminars or anything else. Click here to ask Jim.

In case you missed it, I encourage you to read my e-letter article from last week, which is part I of the case for going international.